Financial Operations

BulkSource’s Financial Operations solutions streamline billing, payments, and financial reporting, reducing administrative burdens for material producers. A customer portal allows clients to view account details, invoices, and payment options, enhancing engagement and convenience. Features like emailed invoices with embedded payment links accelerate the payment process and improve cash flow. The platform supports multiple secure payment methods, including credit, debit, ACH, and checks, while adhering to PCI compliance standards to protect sensitive data. Automated tax management and invoicing tools reduce errors and ensure compliance with jurisdictional regulations. Dynamic reporting provides insights into payment trends and customer behavior, helping businesses make data-driven decisions. By integrating seamlessly with sales and site operations, BulkSource ensures a cohesive financial ecosystem that fosters accuracy, efficiency, and trust.

Features & Functions

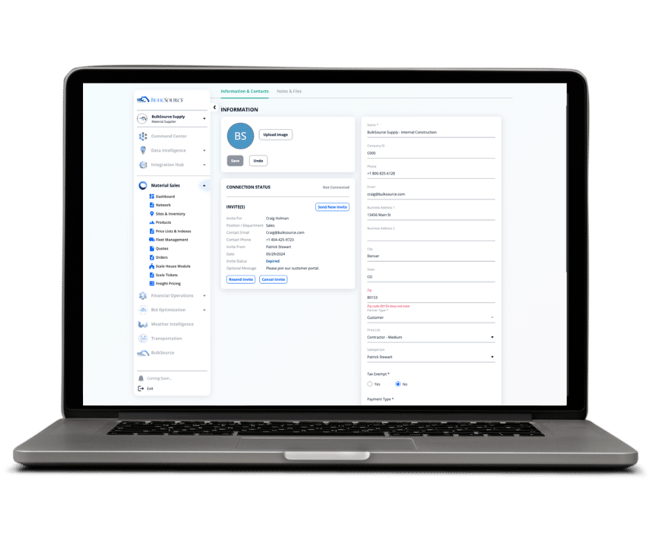

- Customer Portal: Empower customers with self-service access to account information, invoices, and payment options, enhancing satisfaction and reducing support overhead.

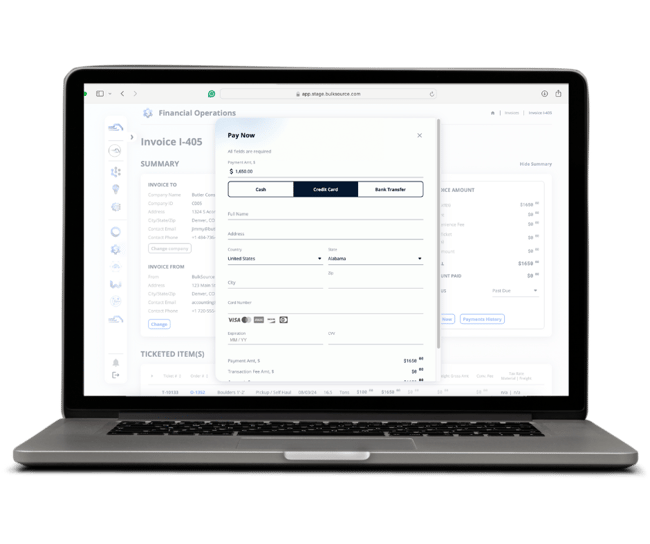

- Digital Payment Options: Offer customers convenient and secure digital payment methods, improving cash flow and reducing late payments.

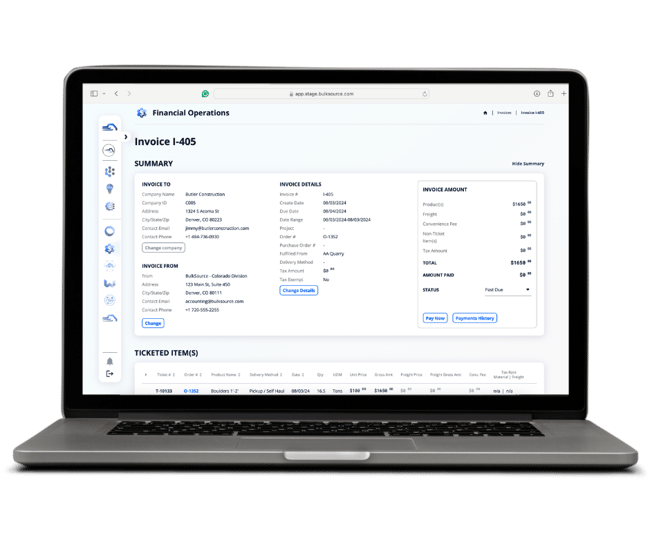

- Emailed Invoice w/ Payment Link: Expedite the payment process by providing direct payment links in emailed invoices, increasing payment efficiency and reducing administrative burden.

- Reporting & Analytics: Gain insights into customer payment behaviors and preferences through reporting and analytics, enabling data-driven decision-making and targeted engagement strategies.

- Invoice Wizard: Streamline the invoicing process with a user-friendly wizard interface, reducing errors and time spent on manual entry.

- Dynamic Tax Management: Automatically calculate and apply taxes based on jurisdiction and regulations, ensuring compliance and accuracy.

- Auto Email Distribution: Automatically send invoices to customers via email, improving efficiency and reducing administrative overhead.

- Payment History: Provide customers with access to their payment history for transparency and reconciliation purposes, enhancing trust and satisfaction.

- Accepts Credit/Debit/ACH/Checks: Offer customers flexibility by accepting multiple payment methods, accommodating their preferences and improving collection rates.

- Multiple Payment Channels: Provide convenient payment channels, including onsite and mobile card readers, online portals, and email-to-pay options, enhancing accessibility and convenience.

-

- Onsite and Mobile Card Readers: Enable secure and convenient on-the-spot payments at physical locations, improving customer experience and reducing processing time.

-

-

-

- Online Portal: Allow customers to make payments conveniently through a secure online portal, reducing friction and improving satisfaction.

-

-

-

- Email to Pay: Simplify the payment process by allowing customers to make payments directly from emailed invoices, increasing convenience and reducing barriers to payment.

-

- PCI Compliant and Secure: Ensure payment transactions are conducted in a secure environment that complies with Payment Card Industry Data Security Standards (PCI DSS), protecting sensitive customer information and reducing the risk of fraud or data breaches.